I've alluded to this topic in my last several posts, in different ways.

It boils down to this: How to afford to not work.

Again there are a million different answers to this question and they hinge around you as a person and your skillsets.

If you are good at saving money: Do that and then just leave when you hit your target. Clearly that is a majority technique. Retirees do this, even if it is not spelled out in the above words. They work until a certain age (the time target) and then go. I'm not a big fan of this method because most of us are battered and broken by the time we hit retirement age making world travel much more resource intensive. But I digress.

This blog is supposed to be about me, and my options, with some insights into what I have done or at least researched in hopes of helping others. Right...?

A few of my friends have done the FIRE+investment real estate. This appears to be a pretty solid option if you are a handy person or have connections in the construction trades. You also need a fairly large investment up front. The payout is that you get a much higher payback in the long run. Ref: my savings graph on the education post. Similar idea to the bottom lines only a huge dip and then a sharper return trend.

Major benefit: Good return on money. Long term potential income.

Detractors: Poor housing market in your area and lack of tenants means no income and you pay for an empty house. You need some way to play landlord remotely or pay a management company if you plan on traveling on that budget.

A more basic plan is to just be a frugal person. But you are not going to have a ton of fun doing that. You will have to change your lifestyle to make this work. Some people are lucky and just did it from the day they left the nest, lucky them as they already have it in their system. Most of us millennials are spoiled little shits that think grinding our own coffee is a drag and that not having a starbucks nearby is the end of the world. (whoops, ranting again) But I feel that it is a fairly honest evaluation of today's society in the USA. People who live a truly frugal and minimal lifestyle are frowned upon and considered weird. I don't know why, but its true.

What I find fascinating is that in other locales I don't get that feeling: When I walk to the grocery store here in Minnesota I can feel people giving me the look as I walk through my subdivision. Yet on the streets of Tamarindo or Santa Rosa Colombia nobody looked twice other than to say hello to a foreigner. weird indeed.

What does it actually cost?

This really is a trick question. There is so much variability person-to-person and situation to situation that it really is very difficult to lend advice here.

Faroutride.com has a very nice breakdown of their costs over the last two years. I think this is a good place to start for fellow USA nationals as they spent most of their first year in the USA and Canada. Why does that matter you ask?? Because, like the Euro zone, the USA is a rather expensive place to be.

If you were to travel in, say, Thailand; the living costs should be significantly lower. typically the more touristy a location is, or easier it is to travel to, the higher the costs.

Example: When I visited Belize in 2016 their peso was worth $0.50. This meant I could buy a nice dinner for me and my girlfriend for about $20, bar tab included.

Example: When I visited Tamarindo, Costa Rica in 2020 their peso was 3500 to the dollar, but the costs were quite large, roughly equivalent to USA prices. This meant I wandered from bar to bar looking for a single dinner that would be less than $25.

So if we use FarOutRide: Their living expenses in 2018 were $32k. That is a relatively large number in my mind but also very realistic. Keep in mind that they are 2 people living in a van.

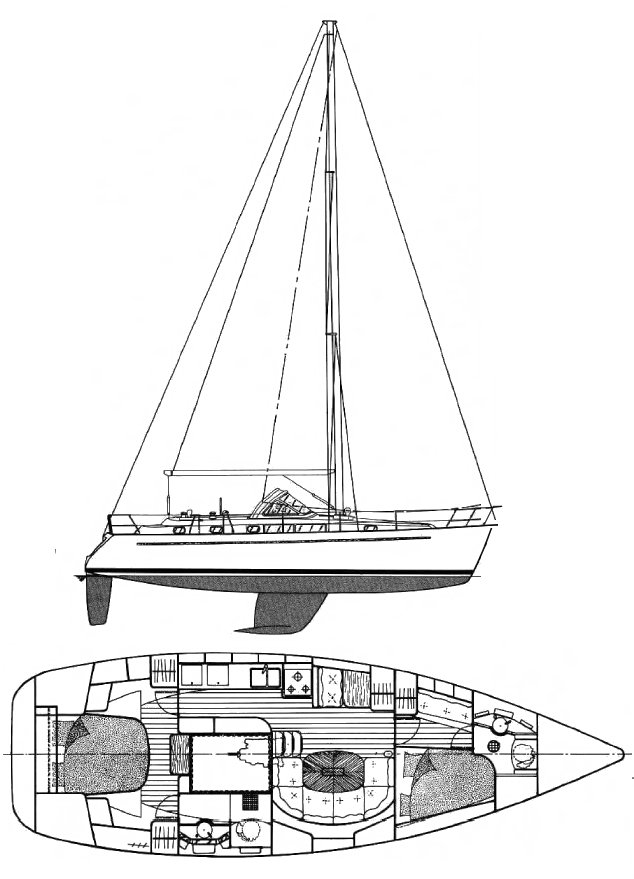

From my reading on cruisers the costs seem to float around but the $1500-2000/month number seems commonplace. That is $24k a year so it seems close enough to the vanlife number to be reasonable.

When

Tula's was still living on their trawler they spent around $18k in a year. and that is not a sailboat! Somehow the first year of owning their catamaran they spent $68k...not sure where all that money came from! But again that plays into the idea that this is so wide and varied in particular situations.

I have not yet found any motorcycle overlanders that published a yearly expense or budget. I will update the blog as soon as I do!

How to afford this life?

This is such an American question. *sigh* Anyway...

In my situation I take home about $45k a year. So such a monthly budget is easily attainable. The problem is that I have to go to work 5 days a week in order to keep that money coming in. Even during this pandemic I go into the office about once a week, and I have my laptop on every weekday.

So my personal situation, today, doesn't really apply.

I think for the sake of this discussion a monthly breakdown is best: What do I spend a month and what might I change in a different situation.

The two listed sources above both check in around $3k US each month.

A couple of hours crunching my last years worth of bank statements gave me a number of $3300/mo and that is just me, in a house by myself. Clearly having a second person to split costs and increase volume discounts is an advantage. We all can't be so lucky it would seem.

Really there is not much that can be cut from the pictured lists. Yikes.

| Mortgage |

1137 |

| Utilities |

150 |

| vehicle payments |

559 |

| vehicle insurance |

160 |

| groceries |

219 |

| Credit card |

881 |

| cellular |

67 |

| restaurants |

128 |

|

|

Clearly a mortgage is my big monthly payment. I pay that amount by myself for the opportunity to live in a house.

After that I spend a shit-ton of money through my credit card, which I could further break down to other categories, but I'm tired right now.

Vehicle costs are huge as a financed land-dweller.

Then finally food. I actually spend less than I thought at only ~$350/mo on groceries and restaurants combined.

So a fairly clear answer to the opening question is: Get rid of debt. If I can achieve that I potentially remove almost $2000/mo! Of course those items would be replaced by others so it is not a strict savings but it is notable.

If I chose to drive a 20 year old honda civic instead of a Mercedes and a newer Jeep I would save probably $600/mo.

The mortgage is a little more complex. I don't like having random roommates. This makes the huge cost worth paying most of the time. Having a partner reduces this cost obviously. The other part to this is potential rental income when travelling.

Rental income.

Income from my real estate: I can likely take in $1700/mo from rental income. That is a potential for $450/mo profit. These are guesstimates from what I have seen on the market. If I can get a reliable renter in my home I can reduce the amount I need to work each month by that $450 amount. It is that easy.